Choosing The Best Health Insurance Plans

Health insurance plans are a modern-day necessity. However, while you’re choosing a health insurance plan, you should consider critical illness insurance. This is one of those health insurance plans that cover you for several major ailments.

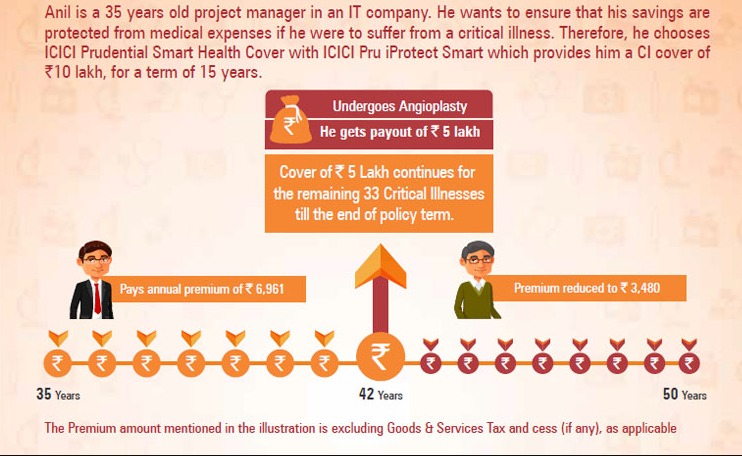

Regular health insurance plans may offer financial security for emergencies and medical treatments however, critical illness insurance comes in handy whenever there is a specific ailment which is life-threatening and endures for a long period of time.

Here are some of the major benefits of these health insurance plans

- The lump-sum amount can be tapped for covering medical expenses and other related costs. Having a constant source of funds helps when it comes to emergencies and helps you safeguard your own savings.

- These health insurance plans help you maintain other financial costs and take care of EMIs even if you are detected with a critical illness.

- There could be several associated expenses linked to illnesses including accommodation, travelling and medicines among other aspects which may lead to funding sources being depleted. These will not be covered by regular health insurance but the lump sum amount paid out will cover all of these associated expenses.

- You get coverage for several specific illnesses with a critical illness policy including cancer, angioplasty, kidney failure, heart attacks, liver disease and so on.

- Money is paid out upon detection of the critical illness and you do not have to submit hospital bills and other proof of expenditure for obtaining the lump sum amount.

- The rate of the premium stays fixed for the whole duration of the plan which is a major benefit.

- All you need is medical documents which prove that you have a critical illness to obtain the benefit.

Major illnesses covered under critical illness plans

Here are some of the critical illnesses that you can get coverage for in your policy-

- Cancer

- Heart Attacks

- Angioplasty

- Surgery to Aorta

- Heart Valve Surgery

- CABG

- Cardiomyopathy

- Primary Pulmonary Hypertension

- Chronic Liver Disease

- Chronic Lung Disease

- Blindness

- Kidney Failure

- Brain Surgery

- Major Bone Marrow/Organ Transplant

- Benign Brain Tumour

- Apallic Syndrome

- Coma

- Major Head Trauma

- Stroke Resulting in Permanent Symptoms

- Permanent Paralysis of Limbs

- Alzheimer’s Disease

- Poliomyelitis

- Motor Neurone Disease with permanent symptoms

- Parkinson’s Disease

- Multiple Sclerosis with persisting symptoms

- Muscular Dystrophy

- Loss of Limbs

- Loss of Independent Existence

- Loss of Speech

- Deafness

- Aplastic Anaemia

- Major Burns

- Medullary Cystic Disease Systematic Lupus Eryth w. Renal Involvement

People who are the sole earning members of their families should opt for critical illness insurance policies. Those who have a medical history of ailments should also go for these policies. People who are above 40 are more vulnerable to suffering from critical illnesses and other disorders.

Also Read: Killer Feminine Calves Best Exercises For Women

They can afford the monthly premium for critical illness plans which makes it a necessity by all means. People who are in stressful jobs have a huge risk of contracting stress-linked diseases. Critical illness insurance can be taken as an add-on to your existing health insurance plan or as a stand-alone policy.